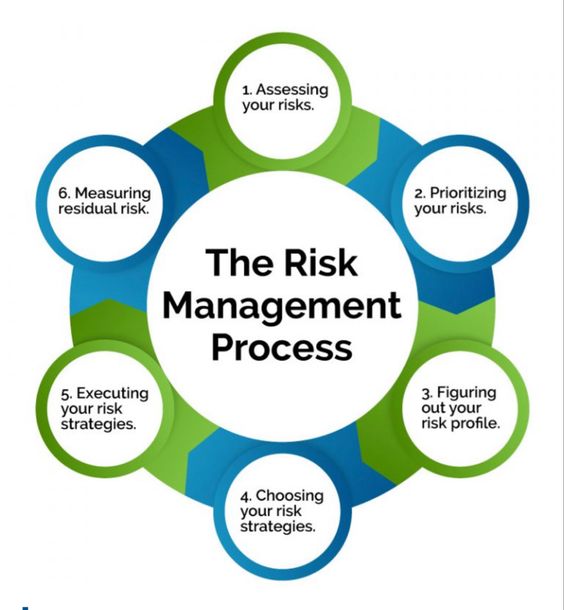

Financial risk management is the practice of analyzing and managing the potential financial risks associated with a business or organization. It involves identifying, assessing, and prioritizing risks, developing strategies to manage those risks, and monitoring and controlling the implementation of those strategies. Financial risk management is an important part of any business or organization’s overall risk management strategy.

Identifying Financial Risks

The first step in financial risk management is to identify potential risks. This involves looking at the organization’s current financial situation and assessing the potential for losses or other adverse effects that could arise from financial decisions or activities. This includes assessing the potential for losses due to changes in market conditions, changes in the regulatory environment, or changes in the organization’s financial position.

Assessing Financial Risks

The next step in financial risk management is to assess the potential risks. This involves looking at the potential losses that could occur if a risk were to materialize. This assessment should include an analysis of the likelihood of the risk occurring, the potential magnitude of the loss, and the potential financial impact of the loss.

Prioritizing Financial Risks

Once the potential risks have been identified and assessed, the next step is to prioritize them. This involves ranking the risks in order of importance, with the most important risks being given the highest priority. This helps to ensure that the organization focuses its resources on the risks that are most likely to cause significant financial losses.

Developing Risk Management Strategies

Once the risks have been identified and prioritized, the next step is to develop strategies to manage those risks. This involves developing strategies to minimize the potential for losses, such as diversifying investments or hedging against market volatility. It also involves developing strategies to mitigate the potential losses, such as setting up insurance policies or establishing reserves.

Implementing Risk Management Strategies

Once the risk management strategies have been developed, the next step is to implement them. This involves putting the strategies into place and ensuring that they are being followed. This may involve setting up systems and processes to monitor and control the implementation of the strategies, as well as ensuring that the organization has the necessary resources to implement the strategies.

Monitoring and Controlling Risk Management Strategies

Once the risk management strategies have been implemented, the next step is to monitor and control them. This involves regularly reviewing the strategies to ensure that they are being followed and that they are having the desired effect. It also involves making adjustments to the strategies as needed to ensure that they remain effective.

Reviewing Risk Management Strategies

Finally, the last step in financial risk management is to review the strategies. This involves evaluating the effectiveness of the strategies and making changes as necessary. This helps to ensure that the organization is able to effectively manage its financial risks and minimize the potential for losses.

You might find these FREE courses useful

- Program Risk Management in ClickUp

- Risk Management in Personal Finance

- Investment Risk Management

- Market Risk Management: Frameworks & Strategies

- Credit Risk Management: Frameworks and Strategies

- FinTech Risk Management

- Implementing a Risk Management Framework

- Risk Management Specialization

Conclusion

Financial risk management is an important part of any business or organization’s overall risk management strategy. It involves identifying, assessing, and prioritizing risks, developing strategies to manage those risks, implementing those strategies, monitoring and controlling the implementation of those strategies, and reviewing the strategies. By following these steps, organizations can ensure that they are able to effectively manage their financial risks and minimize the potential for losses.