A written loan agreement is essential whenever money is lent between individuals, partners, or businesses. It protects both lender and borrower by clearly documenting the amount borrowed, repayment expectations, and consequences of default.

Without a formal agreement, misunderstandings can arise around due dates, interest calculation, partial payments, collateral rights, and legal enforcement. Free simple loan agreement templates in Word and PDF provide ready-to-use formats that make lending arrangements clear, professional, and easier to manage.

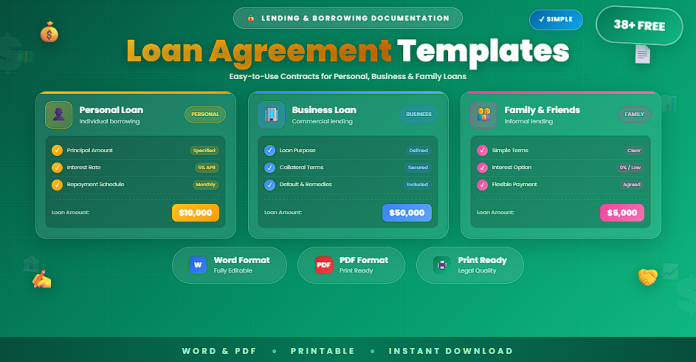

This guide includes 38+ free simple loan agreement templates for personal loans, business financing, installment repayment plans, and secured or unsecured lending.

What Is a Loan Agreement?

A loan agreement is a legal contract between a lender and a borrower that defines the terms under which money is borrowed and repaid.

A standard loan agreement usually includes:

- Lender and borrower identification details

- Principal loan amount

- Interest rate (if applicable)

- Repayment schedule and due dates

- Payment method and prepayment rules

- Late fee and default provisions

- Collateral/security terms (for secured loans)

- Governing law and dispute resolution clauses

- Signature and date fields

A clear agreement helps reduce financial and legal risk for both parties.

Why Use Free Simple Loan Agreement Templates?

Using free simple loan agreement templates provides practical and legal advantages.

Key benefits include:

- Clear written proof of lending terms

- Better repayment tracking and accountability

- Reduced disputes over payment timing and amounts

- Easier enforcement if default occurs

- Editable structure for different loan types

- Print-ready documentation for signatures and records

Templates help turn informal lending into structured financial agreements.

38+ Free Simple Loan Agreement Templates (Word and PDF)

Below is a curated collection of loan agreement templates, grouped by lending purpose and repayment structure.

Core and General Loan Agreement Templates (1–12)

- Standard Loan Agreement Template

- Simple Loan Contract

- One-Page Loan Agreement

- Editable Loan Agreement (Word)

- Printable Loan Agreement (PDF)

- Personal Loan Agreement Template

- Business Loan Agreement Template

- Family Loan Agreement Form

- Friend-to-Friend Loan Contract

- Basic Borrowing Agreement

- General Repayment Contract Template

- Universal Loan Agreement Starter

Payment and Interest Structure Templates (13–24)

- Installment Loan Agreement Template

- Monthly Repayment Loan Contract

- Weekly Repayment Loan Agreement

- Balloon Payment Loan Template

- Interest-Free Loan Agreement

- Fixed Interest Loan Contract

- Variable Interest Loan Agreement

- Late Payment Penalty Clause Template

- Grace Period Loan Addendum

- Early Repayment (Prepayment) Clause Template

- Partial Payment Plan Agreement

- Loan Restructuring Addendum

Secured, Legal Protection, and Enforcement Templates (25–38+)

- Secured Loan Agreement Template

- Unsecured Loan Agreement Template

- Collateral Pledge Loan Contract

- Promissory Note + Loan Agreement Bundle

- Guarantor-Backed Loan Agreement

- Co-Borrower Loan Contract Template

- Default and Acceleration Clause Addendum

- Debt Settlement Agreement Template

- Loan Extension Agreement

- Loan Assignment/Transfer Clause Template

- Dispute Resolution Loan Addendum

- Cross-Border Loan Agreement Template

- Complete Simple Loan Templates Pack

- Loan Agreement Review Checklist

- Loan Payment Tracking Attachment Template

Why Use Word and PDF Formats?

Using both formats improves the full loan documentation workflow.

Format advantages include:

- Word: Best for editing terms, repayment tables, and custom clauses

- PDF: Best for finalized, print-ready signatures and secure recordkeeping

Together, they support both drafting flexibility and execution consistency.

Best Practices for Loan Agreements

To make loan contracts stronger and clearer:

- Record exact principal amount and disbursement date

- Define repayment schedule with specific due dates

- Clarify interest rate method and late fee calculation

- Add collateral details where applicable

- Include written default and remedy provisions

- Keep signed copies and payment records organized

- Update agreement through signed addendums when terms change

Detailed documentation reduces misunderstandings and enforcement challenges.

Common Mistakes to Avoid

When preparing loan agreements, avoid:

- Vague repayment language

- Missing due dates or payment method details

- Unclear interest or penalty calculations

- No written default process

- Verbal amendments not documented in writing

- Using outdated templates without context-specific edits

Precision is essential in financial contracts.

Frequently Asked Questions

Do personal loans require a written agreement?

Yes. A written agreement is strongly recommended to protect both parties and clarify repayment terms.

Can a loan agreement be interest-free?

Yes. The contract can explicitly state that no interest applies.

Should collateral be described in detail?

Yes. For secured loans, collateral details should be precise and verifiable.

Why use Word and PDF templates together?

Word is ideal for customization; PDF is ideal for final signature and record retention.

Can loan terms be changed after signing?

Yes. Changes should be documented through a signed amendment.

Conclusion

A clear loan agreement is essential for safe and transparent lending, whether personal or commercial. The 38+ free simple loan agreement templates in Word and PDF in this guide provide practical frameworks for principal, repayment, interest, collateral, and default terms.

With the right template, lenders and borrowers can reduce risk, improve repayment clarity, and maintain reliable financial records from start to finish.